More About Kam Financial & Realty, Inc.

The Facts About Kam Financial & Realty, Inc. Revealed

Table of ContentsKam Financial & Realty, Inc. Things To Know Before You BuyThe Facts About Kam Financial & Realty, Inc. UncoveredSome Of Kam Financial & Realty, Inc.Not known Facts About Kam Financial & Realty, Inc.Getting The Kam Financial & Realty, Inc. To WorkKam Financial & Realty, Inc. - Truths

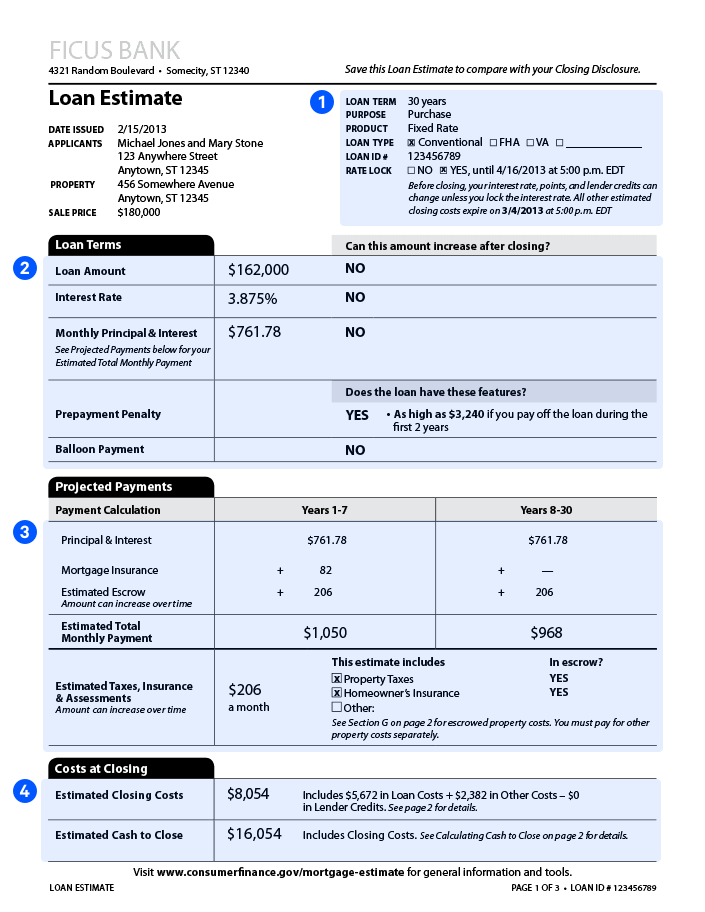

A home loan is a financing utilized to acquire or preserve a home, story of land, or other genuine estate.Home loan applications undergo an extensive underwriting procedure prior to they reach the closing stage. Mortgage kinds, such as traditional or fixed-rate lendings, differ based on the debtor's needs. Home mortgages are loans that are used to purchase homes and other kinds of realty. The residential property itself acts as collateral for the funding.

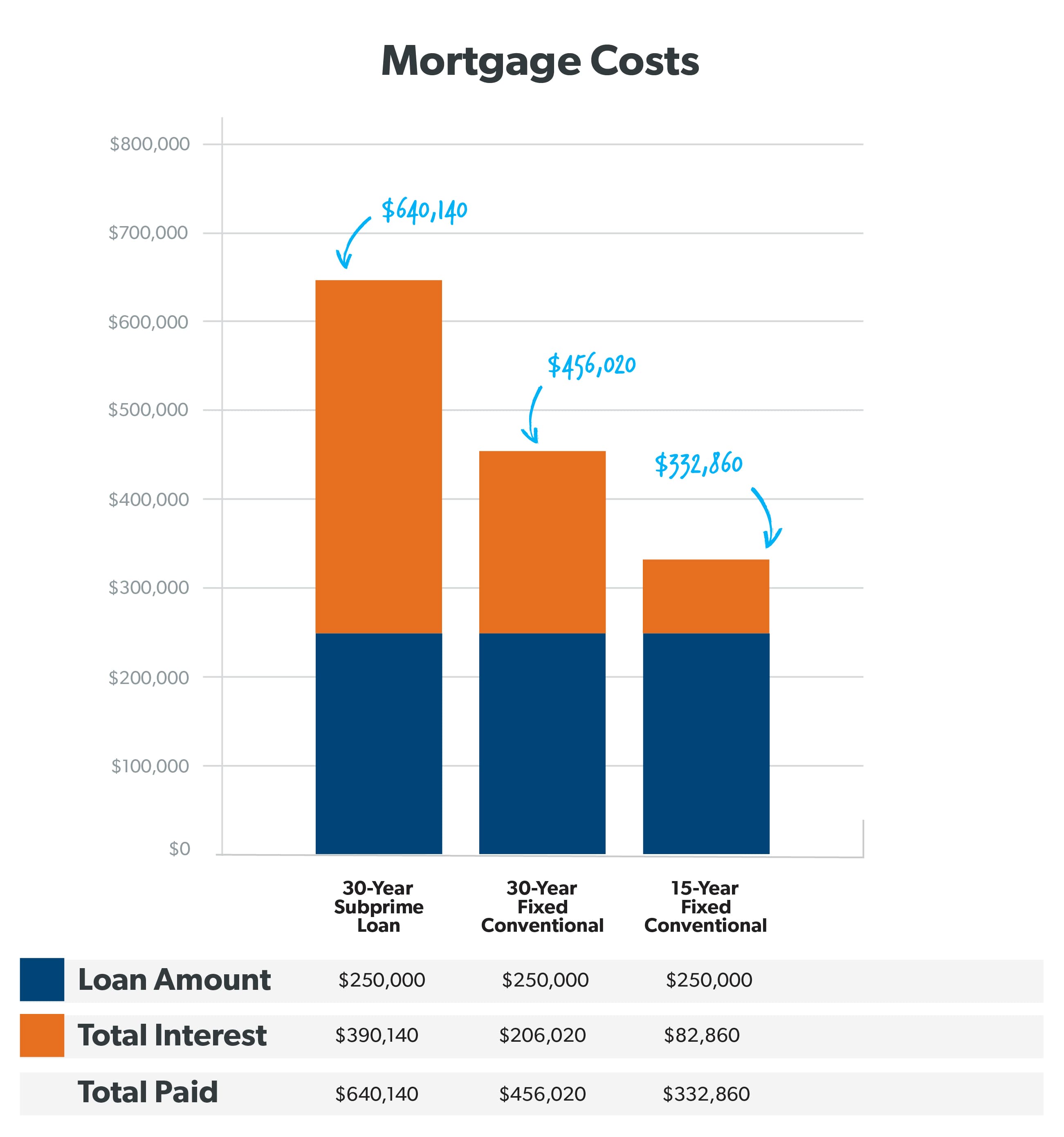

The cost of a home loan will depend on the sort of car loan, the term (such as three decades), and the passion price that the loan provider costs. Home loan rates can differ widely relying on the sort of product and the credentials of the applicant. Zoe Hansen/ Investopedia People and companies use home mortgages to buy realty without paying the whole acquisition rate upfront.

All about Kam Financial & Realty, Inc.

Many conventional home mortgages are fully amortized. This implies that the regular payment amount will certainly stay the same, however various percentages of primary vs. interest will certainly be paid over the life of the funding with each repayment. Normal home loan terms are for 15 or thirty years. Mortgages are also called liens against residential property or claims on property.

A domestic buyer promises their house to their loan provider, which after that has a claim on the home. In the instance of foreclosure, the loan provider may evict the residents, sell the building, and make use of the cash from the sale to pay off the home loan financial obligation.

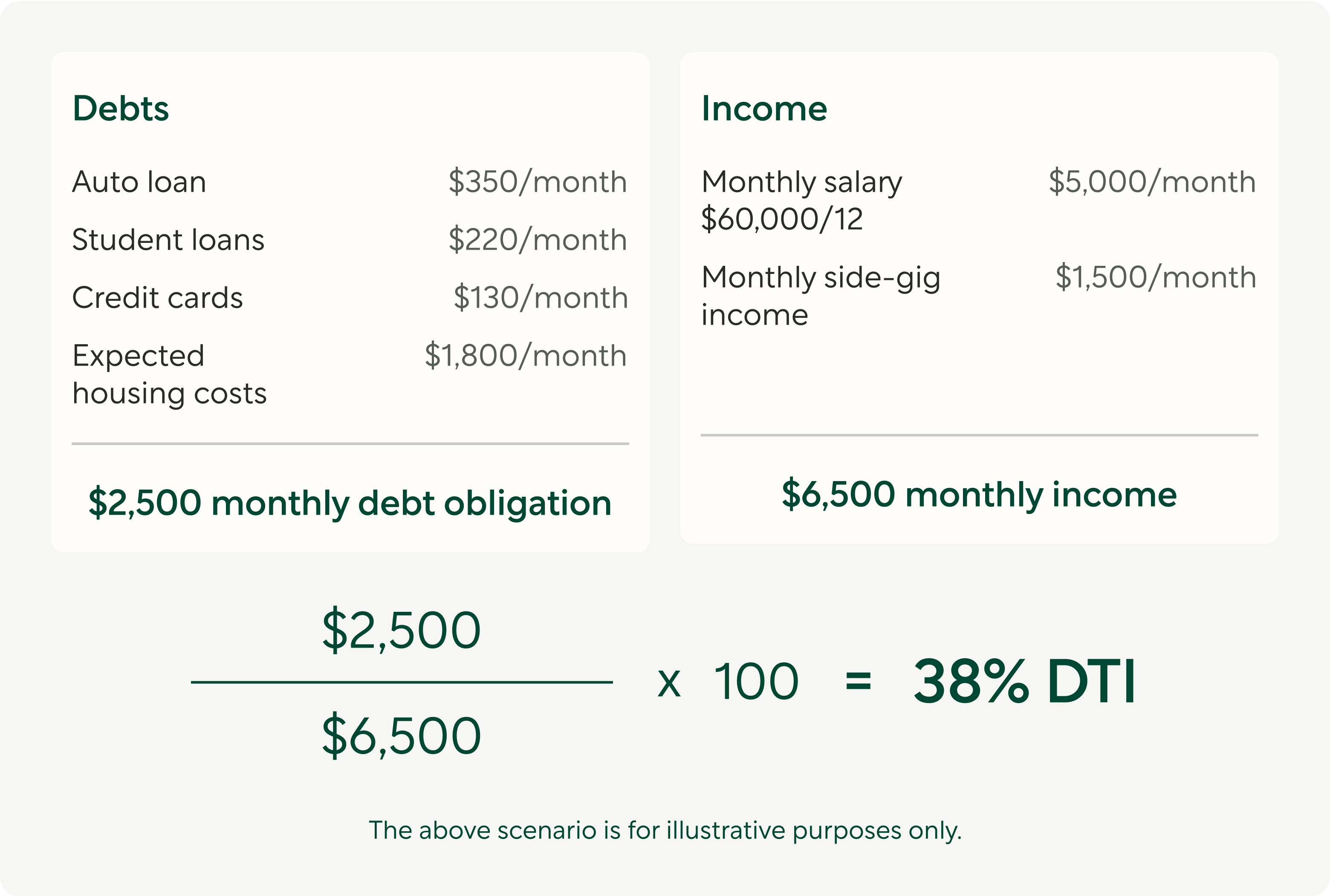

The loan provider will ask for proof that the customer is capable of repaying the car loan. https://www.tumblr.com/kamfnnclr1ty/759999404932497408/our-mission-is-to-serve-our-customers-with?source=share., and proof of current employment. If the application is approved, the lender will certainly offer the consumer a funding of up to a specific amount and at a certain rate of interest price.

The Greatest Guide To Kam Financial & Realty, Inc.

Being pre-approved for a home loan can offer purchasers an edge in a tight real estate market due to the fact that sellers will certainly understand that they have the cash to back up their offer. As soon as a purchaser and seller agree on the terms of their bargain, they or their representatives will certainly fulfill at what's called a closing.

The seller will transfer possession of the residential property to the buyer and receive the agreed-upon amount of cash, and the purchaser will certainly authorize any type of remaining home loan files. There are hundreds of options on where you can obtain a home mortgage.

The Best Strategy To Use For Kam Financial & Realty, Inc.

The common type of home mortgage is fixed-rate. With a fixed-rate mortgage, the rates of interest stays the exact same for the entire term of the loan, as do the customer's month-to-month repayments toward the home mortgage. A fixed-rate mortgage is additionally called a traditional home mortgage. With an adjustable-rate home mortgage (ARM), the rate of interest is repaired for a first term, after which it can alter periodically based upon dominating rates of interest.

9 Simple Techniques For Kam Financial & Realty, Inc.

The entire funding equilibrium comes to be due when the consumer passes away, moves away permanently, or markets the home. Factors are essentially a charge that customers pay up front to have a reduced interest rate over the life of their finance.

Kam Financial & Realty, Inc. Can Be Fun For Anyone

Just how much you'll need to spend for a home loan relies on the type (such as fixed or adjustable), its term (such as 20 or 30 years), any type of discount rate factors paid, and the rates of interest at the time. mortgage broker in california. Rate of interest can differ from week to week and from lending institution to lending institution, so it pays to go shopping about

If you default and confiscate on your home loan, nevertheless, the financial institution may end up being the brand-new owner of your home. The rate of a home is typically much above the amount of money that many homes conserve. Consequently, home loans enable people and households to purchase a home by taking down only a reasonably tiny deposit, such as 20% of the purchase cost, and acquiring a loan for the balance.